In 2020, the "black swan" of the coronavirus epidemic flapped its wings and set off strong winds and waves, disrupting the originally peaceful world. Offline social activities are suspended, schools are suspended, and industries are suspended. All aspects of people's social life have been disrupted by this "black swan". Among them, the global economy suffered heavy losses, and the LED display application industry was inevitably implicated. Under the new development pattern of domestic and international dual circulation, LED display-related companies quickly adjusted their strategies in terms of products and channels, and actively responded to the new normal of the epidemic.

Although the epidemic crisis has not been completely resolved, my country's economy is gradually recovering, and the LED display application industry has also made steady progress. Breakthroughs have been made in the fields of small spacing and Mini/Micro LED, and the development space in various market segments has continued to expand. As the epidemic is gradually brought under control and the global economy gradually recovers to the level before the epidemic, the LED display application industry will shine on a broader stage.

1. The industry remains stable as a whole, showing a gradual recovery trend

As a growth industry, the fundamentals of the LED display application industry remain stable

The "black swan" event of the COVID-19 outbreak in 2020 has had a major impact on the global economy. In order to prevent the spread of the epidemic, many industries were forced to shut down in the first half of the year, the global economic development slowed down, and the GDP declines in various countries generally hit historical extremes. The IMF predicts that the global economy will shrink by 4.2% in 2020, and the global GDP decline will be seven times that of the 2009 financial crisis.

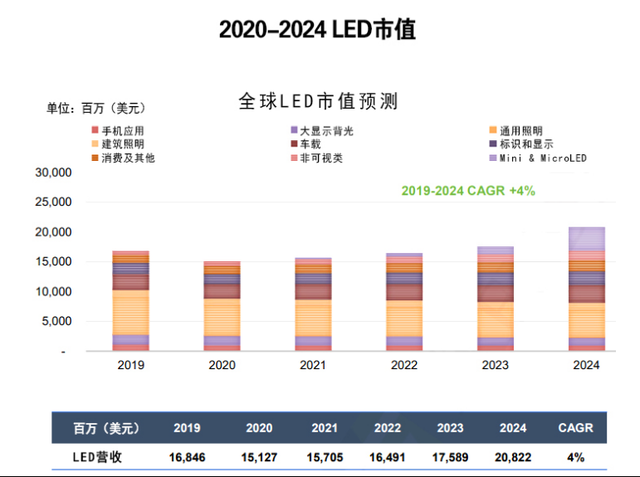

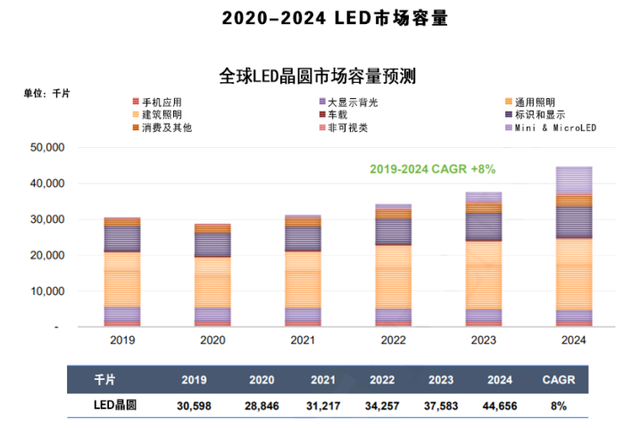

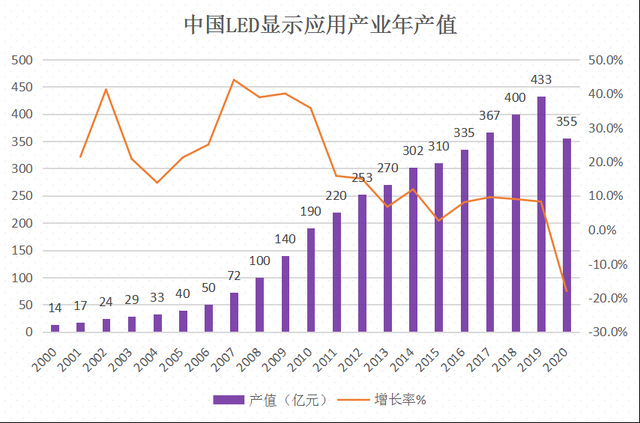

Data from relevant institutions shows that the total global LED market value in 2020 is about US$15.127 billion (about 98.749 billion yuan), a year-on-year decrease of about 10.2%; the LED wafer market capacity is about 28.846 million pieces, a year-on-year decrease of about 5.7%. Among them, the annual output value of my country's LED display application industry is expected to drop by about 18%, reaching 35.5 billion yuan.

2020-2024 Global LED Market Value Forecast

2020-2024 Global LED Wafer Market Capacity Forecast

Statistics of annual output value of China's LED display application industry

During the epidemic, with the introduction and implementation of a series of domestic measures, including domestic and international dual circulation and new infrastructure led by 5G, my country's economy has recovered rapidly and is the only major global economy to achieve positive growth in 2020. s country. The domestic LED display application industry has also gained a lot of opportunities from it. For example, commercial display, professional display and other market segments have grown. In the second half of 2020, related companies have increased orders, more projects, and improved performance, showing a strong performance. vitality.

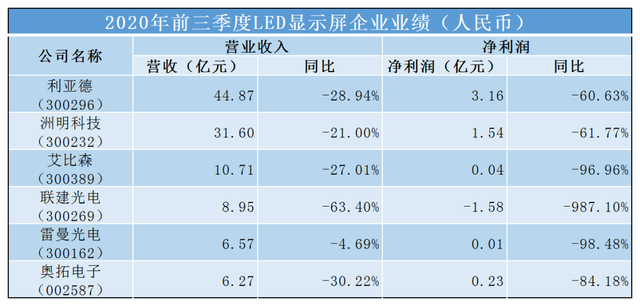

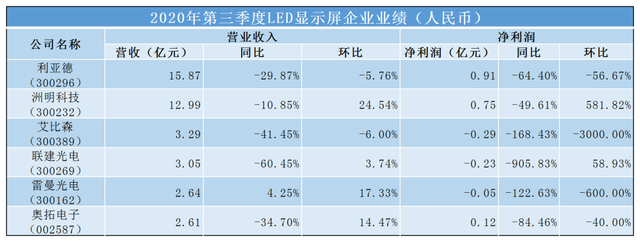

Judging from the performance of the six major listed companies in my country's LED display industry, affected by factors such as the epidemic, the operating income and net profit of LED display companies in the first three quarters decreased compared with the same period in 2019, of which the largest decline was Lianjian. photoelectric. However, as far as 2020 is concerned, both operating income and net profit have increased in the third quarter, and the increase is expected to be even greater in the fourth quarter.

Performance of LED display companies in the first three quarters of 2020

LED display company performance in the third quarter of 2020

During the special period, the leading enterprises have demonstrated their unique strengths. New products and new businesses are gathered in the leading enterprises, and the brand role has gradually become prominent. Among the six listed companies of LED display, although the growth rate in the first three quarters was not as good as before, except for Lianjian Optoelectronics, which lost 158 million yuan, the rest of the companies made profits. In contrast, other small and medium-sized enterprises are facing difficulties in their survival. In October 2020, news that many enterprises could not support it broke out - the tight capital chain of Gertlon caused the contradiction between supply and demand; Dehao Runda shut down the LED display business; CREE sold the LED product division to SMART, etc. Companies have expressed concerns about the development of the industry in the post-pandemic era.

As a growing industry, the development of the LED display application industry mainly relies on the advancement of LED display technology, the introduction of new products and the quality of services. Despite the huge impact of the epidemic on the market, the fundamentals of the industry remain stable and the overall trend is positive.

Price fluctuates, first fall and then rise

In the early days of the outbreak of the new crown pneumonia, the industry development pressed the pause button. Due to the decline in terminal demand for LED display applications, orders from LED packaging companies have decreased sharply, resulting in a large accumulation of inventory. In order to clear inventory, LED packaging companies "exchange price for volume" and sell products at reduced prices. In 2020, the price of indoor lamp beads dropped by an average of 22.19%.

With the prolonged shutdown of production, the supply of raw materials such as copper clad laminates has dropped sharply, and the supply in the global market is in short supply.

Then, the U.S. Department of Commerce further sanctioned Huawei in an attempt to cut off the chip manufacturing supply chain, resulting in a “cut of supply” for a group of Chinese companies on the memory chip side. Due to Huawei's large-scale stocking, wafer shipments were tight and prices rose. It is expected that by June 2021, products that rely on wafer processes, such as driver ICs, will maintain a tight supply and demand situation.

Under the influence of the epidemic in 2020, raw materials such as PCB boards, driver ICs, wafers, and RGB lamp beads upstream of LED displays have experienced price fluctuations to varying degrees. Before the global epidemic is completely controlled, companies in the upper, middle and lower reaches of LED display need to improve the predictability of price changes and the timeliness of responding to price changes.

2. Diversified development of market segments

The complex situation in 2020 makes the LED display application market show different characteristics in the subdivisions, and the subdivisions show diversified development.

The overseas market is shrinking rapidly, and the domestic channel is stepping up the layout

The global epidemic is raging, countries have reduced their foreign exchanges, temporarily closed the door of import and export, and overseas markets have shrunk rapidly. According to customs statistics, in the first 11 months of 2020, the total value of my country's foreign trade imports and exports was 29.04 trillion yuan, a year-on-year increase of 1.8%, a decrease of 0.6% compared with the 2.4% growth rate in 2019.

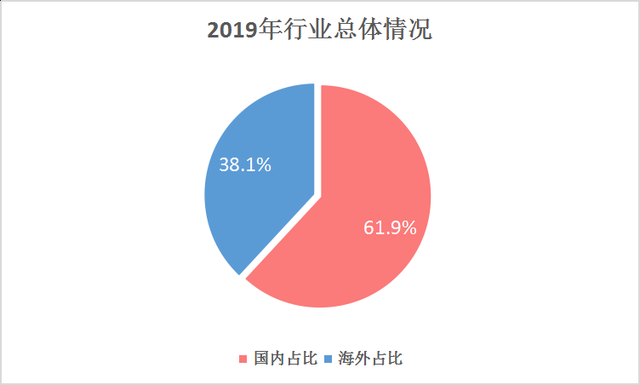

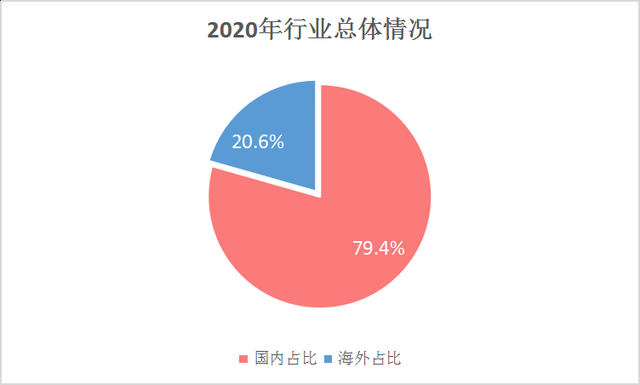

In addition, U.S. trade protectionism is still prevalent, and Chinese semiconductor companies are restricted from investing and conducting business in the United States. In the field of semiconductors, the United States has imposed additional tariffs on semiconductor-related equipment and components, integrated circuits and components, LEDs, discrete devices, and printed circuit boards. The adverse effects slowed down the speed of market expansion and industrial development to a certain extent. According to statistics, the overseas market of the LED display industry will account for about 20.6% in 2020, a decrease of 17.5% from 2019.

The overall situation of the LED display industry in 2019

The overall situation of the LED display industry in 2020

Due to the inability to "go global", companies that are deploying in overseas markets have to turn their focus to the domestic market and expand domestic channels. In 2020, the domestic market of the LED display industry will account for about 79.4%, an increase of 17.5% over 2019.

As an LED display company that has penetrated into overseas markets, Absen will invest nearly 50 million yuan in 2020 to expand domestic channels to cope with the challenges brought by the epidemic. At the beginning of 2020, through a large number of market researches, Absen has launched Kunlun KL and Rolling Stone GS series new products into the channel market on the one hand, and implemented the CD337 channel expansion strategy "tree planting plan" according to the characteristics of the domestic channel market. It has established a channel network covering all prefecture-level cities, which has been highly recognized by channel partners. Coincidentally, during the epidemic in 2020, Unilumin vigorously promoted the sinking of channels and the integration of channel empowerment by carrying out the "Spark Plan", "Liaoyuan Plan" and "Channel Progress Meeting" in 31 provinces and cities across the country, further consolidating its own channel basis. On the basis of the original relatively complete "1+N+W" channel, Leyard has improved market coverage by further sinking channels, and expanded the space in different segments through different business groups. From June to September 2020, Ledman established three marketing centers in East China, South China and North China, and held the Ledman COB Product Promotion and National Online Investment Conference, inviting partners, and will fully support channels with professional capabilities in the future Business becomes bigger and stronger. Companies such as Lianjian Optoelectronics and Alto Electronics have also stepped up efforts to develop domestic channels and engineering projects, and launched related products such as medical and conference all-in-one machines to expand the domestic market.

The hot domestic channel market layout has largely "melted" the cold winter of 2020, making the LED display industry re-active in various places, which will become a strong guarantee for the development of the LED display industry in the post-epidemic era.

The rental market declines, and outdoor large screens perform well

Due to the needs of epidemic prevention and control, social gathering activities have been greatly reduced. The Tokyo Olympics and the European Cup have been pressed the pause button, cinemas have closed, and the LED display rental market such as domestic tours, music festivals, and sports events has also declined accordingly.

At the end of January 2020, many singers and bands issued announcements to suspend or postpone their performances one after another. According to incomplete statistics from the China Performance Industry Association, in the first quarter alone, nearly 20,000 performances were cancelled or postponed nationwide, and some performances did not gradually resume until the second half of the year. However, according to regulations, the number of spectators in the performance venues at the beginning of the opening shall not exceed 30% of the seats, which is much lower than the attendance rate of 60% (usually 60% is profitable). For rental equipment manufacturers, the budget for activity expenses has been greatly reduced, and the profit margin of LED displays has also been compressed. As one of the important application markets for LED displays, the decline in the rental market has brought a huge impact on LED display-related companies.

However, in the second half of the year, with the gradual control of the epidemic and the increase in activities in non-closed places in China, the outdoor display market recovered quickly. Since May 2020, when the waves in South Korea's Samsung LED display "rushed" into the hot search, there has been a boom in outdoor "naked eye 3D" in China. Samsung's "same style" outdoor screens have appeared in Guangzhou Beijing Road, Chengdu Taikoo Li, Chongqing Guanyin Bridge, Shenyang Middle Street, Wuhan Jianghan Road, Xi'an High-tech Software New City and other places. These screens have attracted many people to stop and watch through the realistic 3D rendering effect, and have become a new landmark of local "Internet celebrities".

In addition to outdoor "3D" displays, outdoor large-scale creative displays have also sprung up. Guizhou Panzhou Moon Mountain Scenic Area "Artificial Moon" Super Project, Shenyang "Hunnan Summer" Culture and Art Carnival LED Screen, Ningbo Yinzhou Southern Business District Moonlight Economic Complex LED Screen, Galanz Shunde Headquarters 800㎡ Special-shaped Screen, Tianjin Love· Large-scale LED display projects such as the 707-square-meter "Water Cube" transparent screen of Binfenli Marketing Center, the LED canopy system project of Sichuan Wansheng City Yunfu Project, and the 8500-square-meter giant LED canopy project of Zunyi High-speed Rail New City have been completed and lit up one after another, becoming another bright spot in the local area. landscape.

With the expansion of application scenarios, people's requirements for outdoor LED displays are getting higher and higher, and LED display products such as transparent screens, grille screens, and naked-eye 3D screens are becoming more and more diverse. Among them, LED transparent screens are widely used in propaganda and display scenes in building media, shopping malls, catering and retailing and other occasions due to the characteristics of arbitrary cutting, transparent display, and no change of building structure. One of the main driving forces for the growth of LED outdoor displays.

In July 2020, Unilumin Technology released 18 new LED transparent screen products in three series of "Magic", "Hidden" and "Crystal" and 7 pitches of Unilumin Cultural and Creative, which can be widely used in commercial complexes, building curtain walls, shop windows, Exhibition halls, museums, etc. The Leyard Vclear-PRO series transparent screen, which has won the German iF & Red Dot International Design Award twice, won the Good Design Award (G-Mark) in Japan in 2020. The progress of my country's LED transparent screen products is not only a symbol of technological progress, but also a sign that the development of my country's LED display application industry has won world attention.

Commercial display market first declines and then rises

Similar to outdoor activities, indoor gatherings need to be avoided as much as possible during the epidemic. Measures such as school closures and industrial shutdowns prevent LED displays from entering the corresponding market segments. The performance of the LED display application industry in the first half of 2020 was not satisfactory.

However, as the so-called "God closes a door for you, he will open a window for you", although the epidemic has restricted people's activities, it has also spawned many online market demands - distance education, online office When demand ushered in a blowout growth, the LED display industry took this opportunity to gain a new market.

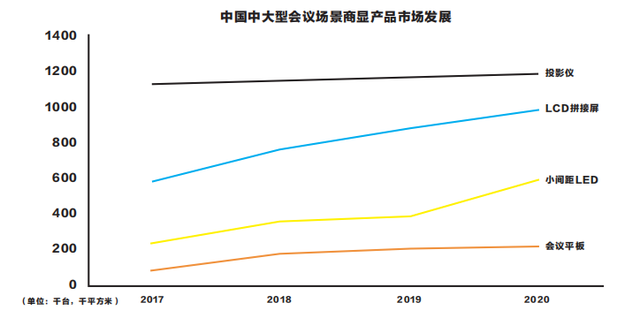

LED conference all-in-one products have shown great development potential during the epidemic. The total sales in the first three quarters were about 1,676 units, with a total sales of about 610 million yuan, a year-on-year increase of 164.3%. The related market will explode in 2020. In 2020, many companies actively responded to the domestic economic cycle strategy and launched LED all-in-one machines. For example, Leyard launched 4K ultra-high-definition TXP 135-inch and 162-inch conference all-in-one machines based on Micro LED technology. In terms of display quality, etc. A qualitative leap has been achieved; Shendecai launched the Melink smart conference all-in-one machine with the advantages of D-COB+Micro LED technology, focusing on medium and large-scale education and conference fields; Krent showed its HUBOARD brand new all-in-one machine products at the ISVE exhibition, It is the world's first ultra-narrow bezel full-screen LED all-in-one machine; Absenicon launched the Absenicon standard size (110"/138"/165"/220") conference screen, and the sales of its conference screen increased by more than 50% compared with 2019; Jian Optoelectronics launched METAGO intelligent display conference terminal, which is specially suitable for medium and large conference rooms, training rooms and other application scenarios; Alto Electronics launched SID intelligent all-in-one machine and CV intelligent conference machine based on MINI LED technology; Ledman launched COB packaging technology based on Micro LED conference all-in-one machine, etc. The LED all-in-one machine has significant advantages in image quality, convenience, intelligent interaction, etc., and is the most standardized product among the LED displays trend.

Market development of commercial display products for medium and large conference scenes in China

Judging from third-party data, there are about 100 million conference rooms in the world, and China accounts for more than 20 million, of which about 3% to 5% of medium and large conference scenes are suitable for LED conference all-in-one machines. 60 billion to 100 billion yuan, the development prospects are very broad.

Professional market steadily rising

Professional markets such as security monitoring, emergency command, medical rescue, etc., due to their particularity and professionalism, are less negatively affected by the epidemic. Not only did they not show a significant downward trend, but they have gained a firm foothold and made steady progress amid the epidemic.

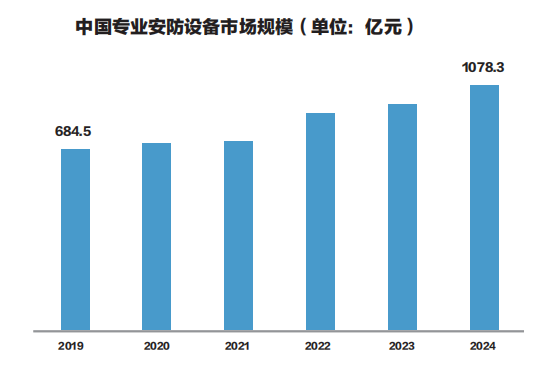

After years of development, compared with other display products, LED display screen is superior in reliability, energy consumption, display effect, response speed, installation convenience, etc., and occupies an irreplaceable position in professional scene applications. Omdia predicts that China's intelligent video surveillance market will reach US$16.7 billion in 2024, with an average annual growth rate of 9.5% from 2019 to 2024.

China's professional security equipment market size

Today, the security monitoring and emergency command market is developing in the direction of intelligence and integration, and as a necessary terminal product for video surveillance systems, LED displays will be better integrated into the security system with the continuous improvement of display technology. Unprecedented growth opportunities.

As far as the medical field is concerned, in addition to security monitoring, the three main scenarios of remote visitation, remote surgery and remote consultation involve the application of video conferencing systems. In recent years, the size of the telemedicine market has grown significantly, especially after the outbreak of the epidemic, the demand for telemedicine has further increased. A good telemedicine application experience requires the blessing of ultra-high-speed transmission, that is, 5G network and ultra-high-definition display, that is, small and micro-pitch LED display. Leyard, Unilumin, Cedar Electronics, Ledman Optoelectronics and other companies have deployed LED all-in-one machines to help the development of telemedicine to help the development of telemedicine. Among them, Unilumin has taken the lead in launching a visualization solution for the new crown epidemic. The visual analysis results of the situation are provided to the epidemic prevention and control headquarters to help improve the quality and efficiency of epidemic prevention and control. In the future, with the development of new medical treatment, LED display will usher in another new blue ocean.

Cross-border integration is on the rise

With the innovation of technology and the development of the market, the phenomenon of cross-border integration in the LED display industry is increasing, and many companies have begun to cooperate across borders and lay out new fields.

In 2020, the display industry is very lively, and many companies in different display fields have achieved cross-border integration, and the trend of competition and cooperation is obvious. In the industry chain, upstream, mid-stream and downstream companies cross borders. For example, Sanan has also deployed chips and packaging, investing 7 billion yuan in gallium nitride, gallium arsenide and special packaging projects; Leyard, in addition to display screens Deploy the Micro LED field through Lijing, etc. The vertical cross-border within the industrial chain has accelerated the speed of industrial integration, which is conducive to improving the efficiency of LED display resource allocation.

At the same time, the horizontal cross-border of enterprises is also very prominent. Traditional display and panel companies such as TCL, LG, GQY, Konka, and BOE have actively entered the LED display field, and have launched a variety of Mini/Micro LED TVs, smart watches and other related products. LED display application industry; CVTE, whose main business is the design, R&D and sales of LCD main control boards and interactive smart panels, completed the acquisition of 16% of Xi'an Qingsong in the first half of the year, and will hold Xi'an Qingsong The shareholding ratio of the company has been increased to 67%, and it has rapidly and deeply integrated into the LED display industry; the leading companies in the security industry, such as Hikvision and Dahua, have launched LED display related products, actively integrating the LED display industry and the security industry, and expanding the development of both. Array; LED display companies such as Leyard, Unilumin, and Absen combine LED display technology with VR, AR, MR and other computer graphics and visualization technologies to expand new ideas for the improvement of stage programs and film and television visual effects ; Even the Internet company Xiaomi and ICT company Huawei have begun to dabble in this field... The cross-border integration of enterprises, investment and establishment of factories, not only exerts the catfish effect, stimulates enterprises in the LED display industry to become active and participates in market competition, and is conducive to the realization of the industry. win-win.

3. Technological innovation emerges endlessly

Although the epidemic has made the market deserted, the research and development of LED display-related technologies is still continuing, and breakthroughs have been achieved in many fields.

In terms of pixel pitch, small pitch is still the mainstream of LED display. Although affected by the epidemic, many companies still bring forth new ideas, such as Leyard, Unilumin, Absen, Ledman, Xida Electronics, Alto Electronics, Corrent, AET, Shende Cai and other companies have launched new small For pitch products, the dot pitch has moved from 0.8mm to 0.6mm and 0.4mm. In the second half of the year, with the recovery of the industry, the conference market is extremely hot. As mentioned above, many companies have successively launched LED small-pitch conference all-in-one products to promote the application and development of small-pitch. According to statistics, the global small-pitch LED display market size in 2020 is 2.6 billion US dollars, basically the same as last year, and the compound annual growth rate from 2020 to 2024 is expected to be 27%. As the point spacing continues to move downward, products below P1.0 will serve as the largest growth driver and maintain rapid growth.

The packaging technologies for realizing small-pitch LED display mainly include four routes: SMD, IMD, front-loading COB, and flip-chip COB. Among them, COB-related technology and IMD technology have become hot topics in 2020.

In terms of COB, the COB camp represented by Cedar Electronics started its layout as early as 2016 and became a typical representative of flip-chip COB technology. In the past two years, the performance and price of COB have been more and more recognized by customers. In 2020, Xida Electronics will launch a flip-chip COB display with the industry's smallest dot pitch of 0.4mm; AET launched QCOB products at the Beijing InfoComm exhibition with two core advantages of wide color gamut and surface light source; GQY Video released a new product "full Flip-chip COB Mini LED energy-saving cold screen”; Ledman launched the Micro LED conference machine based on COB packaging technology; Zhongqi Optoelectronics launched the new P1. In the form of giant screen super 8K, the full-flip-chip Mini COB was exhibited in the industry; Shendecai exhibited products based on D-COB technology; Jingtai released a series of products using COB solution, full-flip-chip packaging technology, and thin-film packaging technology P0.62 Micro LED display module; Victron plans to continuously improve the process of flip-chip COB products, and start the pre-research of AM-COB products in a timely manner. The market acceptance of COB technology is gradually improving. With the entry of more enterprises, COB technology is expected to open the door to large-scale commercialization.

Nationstar launches IMD-M05 in March 2020

In terms of IMD, Nationstar launched the IMD-M05 in March, which integrates 12 full-flip-chip LEDs in the length and width of 1010, further reducing the mass-produced display pixels to 0.5mm level, marking the official development of Mini LED. Enter the era of 100-inch high-definition display; later, IMD-M09 standard version was launched in November, which can undertake the advantages of SMD 1010 in terms of scale and price. At present, Nationstar Optoelectronics Mini LED family has IMD-M05/M07/M09/F12/F155 products, the IMD production capacity can reach 1000KK/month, and it is expected to increase significantly in the first quarter of 2021. In addition, Huatian Technology's IMD (four-in-one) P1.5/P1.2/P1.0/P0.9/P0.8 products have been mass-produced; Dongshan Precision has applied for a patented rubber surface treatment technology, with ultra-black ink color , ultra-high contrast ratio and high ink color consistency, it has been laid out in indoor two-in-one RGB and indoor four-in-one RGB.

In terms of LED discrete devices, in 2019, the head of Zhaochiguang launched full-flip-chip 1010 small-pitch packaging products, which have the advantages of high solder joint reliability, less metal migration, high brightness, and low power consumption. The F0808 product has entered the stage of small batch production. Cinda Optoelectronics brought 1010 CHIP package, 1010 TOP type package and 1010 flip chip package products to the ISE exhibition in 2020. Now Cinda Optoelectronics Xiamen production base has established a flip chip production line to realize the mass production of flip chip lamp beads sex. Jingtai Hummingbird 1010 has been iterated to version 3.0 so far. The solution still adopts the CHIP structure, and major optimization and upgrades have been made in the chip and packaging process. The 1515 device also perfectly replaces the 2121 device in the field of outdoor display, effectively solving common pain points such as dead lamp failure, lamp bead string lighting, caterpillar (migration), and color inconsistency.

In terms of common cathode technology, many companies have successfully applied this technology to LED displays, which meets the requirements of green development of the industry. In addition to energy saving, common cathode technology can also reduce the temperature of LED lamp beads and improve the reliability and stability of LED display products. Lianjian Optoelectronics Mini LED display technology is based on a common cathode drive design, changing the traditional single-voltage power supply to dual-voltage power supply. The red light uses a 2.8V driving voltage, and the green and blue chips use a 3.8V driving voltage, reducing the overall power by 15%. about. Unilumin ROE has also developed the Amber0.9 Amber series of ultra-fine pitch indoor high-end fixed-mount Mini LED products based on common cathode drive technology and IMD four-in-one packaging technology. Absen HC series control room field small-pitch LED display adopts common cathode energy-saving technology, accurate power supply, lower power consumption, energy saving and environmental protection. Hisun Hi-Tech Nyx COB small-pitch display adopts the dual combination of COB technology and common cathode technology, which has significant advantages in product stability, luminous effect, durability, and power consumption. Using common cathode technology, it can effectively save 30% of energy.

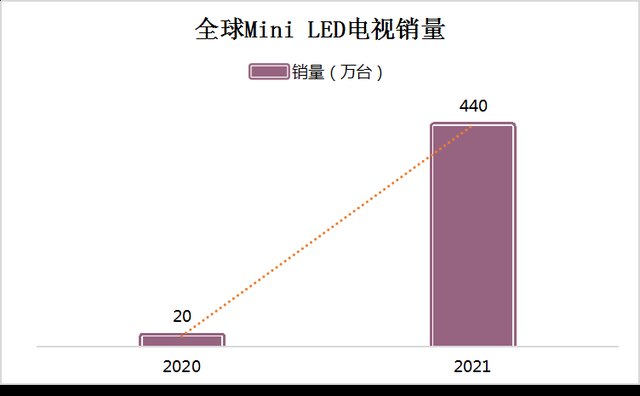

In terms of new display technology, Mini/Micro LED display has made a major breakthrough. According to statistics, the new investment in the Mini/Micro LED field in 2020 has reached nearly 43 billion yuan, which has achieved several times growth compared with 2019. 2020 is called the first year of Mini LED. With the continuous reduction of pixel pitch, the layout of Mini LED related projects and the frequency of new product releases have increased, and many companies have even announced the mass production of Mini LED backlights. Shendecai Mini LED smart display production project settled in Chuzhou; TCL acquired Maojia International, Skyworth LCD officially launched the mass production of Mini LED products; LG and Xiaomi released Mini LED backlight TV, etc. Mini LED TVs have formed a trend of large-scale development in 2020. According to data, the global sales of Mini LED TVs will be 200,000 units in 2020, and it is expected to increase to 4.4 million units in 2021. The color TV industry will compete with OLED TVs in 2021.

Global Mini LED TV sales forecast

Micro LED also achieved dazzling results. Since Samsung launched a 583-inch enterprise-level Micro LED display at ISE 2020 in February, Micro LED upstream, midstream and downstream have accelerated the development of Micro LED. In the upstream, Taiwan Epistar has broken through the technical bottleneck of Micro LED chip sorting. It is expected that after the test is completed in the next 2 to 3 years, TV or other large-scale terminal products can be produced in 3 to 4 years; Leyard participates in the competition of the company Fullerix successfully used NPQD Micro LED color conversion technology to light up NPQD Mini/Micro LEDs with high luminous efficiency, high reliability and low cost, and prepared high-resolution on-wafer/on-chip RGB Micro LED arrays; Tianjin Sanan Breakthroughs in Micro LED epitaxial structure involve technologies such as material growth, high-yield mass transfer, etc., and successfully developed RGB three-color Micro LED chips. In the midstream, Lijing's world's first Micro LED mass production base was officially put into production; Jingtai released the P0.62 Micro LED display module of the product screen series; Nationstar Optoelectronics released the first-generation Micro LED display new product nStar I, which realizes passive driving of Micro LEDs. LED full-color display, and on this basis, developed an active drive Micro LED full-color display based on TFT glass substrate. In the downstream, AUO cooperated with Chitron to develop 9.4-inch high-resolution flexible Micro LED displays; Leyard released four mass-produced Micro LED commercial display products of P0.4/0.6/0.7/0.9; Ledman released Micro LED pixels Engine technology; TCL Huaxing, Tianma, LG, Innolux, Konka and other companies have successively launched Micro LED related products. In addition, the release of the "Micro-LED Industry Technology Roadmap (2020 Edition)", the convening of numerous conferences, the introduction of relevant specifications, and the release of the "Micro LED Display Technology and Application White Paper" in the industry have opened up the industrialization of Micro LED display path.

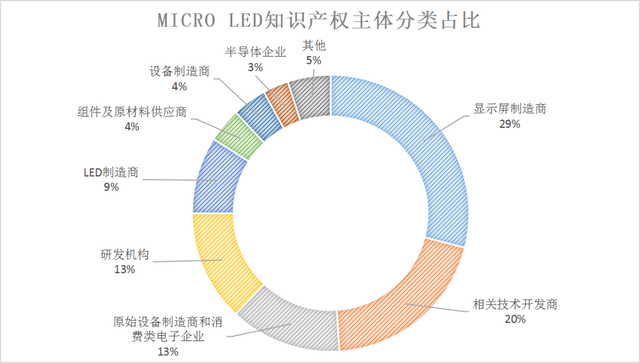

As we all know, the healthy development of technology requires the protection of patents. In recent years, the patent application and protection awareness of the LED display industry has increased. From 2018 to 2019, the patent application of Mini LED began to show a rapid growth trend. The annual application volume is about 200, of which my country accounts for about 70% of the total global application. . From the perspective of the main applicants, the top three applicants in the Mini LED field are China Star Optoelectronics, BOE and Longli Technology. Among them, most of the patent applications of CSOT and Shenzhen Longli on Mini LED are backlight modules and display panels; BOE's patent applications not only involve backlight modules and display panels, but also involve Mini LED chips themselves. In the field of Micro LED, the main applicant companies are foreign companies, and there are fewer domestic companies. In 2020, the number of patent applications for Micro LED will surge, and the patent competition between Apple and Microsoft will become increasingly fierce.

Proportion of Micro LED intellectual property subject classification in 2020

In 2020, there will be many patent applications for Mini/Micro LED, including Dongguan Zhongjing Semiconductor Technology Co., Ltd., which improves the subsequent epitaxial barrier by setting a gallium nitride platform support layer between the epitaxial barrier substrate and the epitaxial barrier layer. Lattice matching degree of the crystal layer (publication number: CN210576000U); Xiamen Colorful Optoelectronics Technology Co., Ltd. proposed the technology of setting chip electrodes and mounting substrates with opposite magnetic properties, and realizing mass transfer through magnetic self-assembly adsorption (publication number: CN109065692A ); Jingneng Optoelectronics Co., Ltd. proposed the technology of embedding the boss structure on the P electrode side of the red chip, green chip and blue chip into the groove of the polyester film, so as to facilitate the bonding of the transparent conductive substrate and the conductive substrate, so as to realize Mass transfer of wafers (public number: CN111063675A); Tianjin Sanan Optoelectronics and Tianjin University of Technology jointly developed RGB three-color Micro LED chips. The chip's red, green, and blue external quantum efficiency reached a high level, and the transfer yield reached 99.9 % or more, 4 invention patents and 2 utility model patents have been applied for; Epistar has accumulated more than 4,400 LED-related patents, including a large number of flip-chip technology and patents that are very important for Mini LED chips...Mini/Micro The increase in the number of LED patent applications also reflects the explosive growth trend of Mini/Micro LEDs.

In order to protect patents, some companies have also launched patent defense battles. In September 2020, Sanan Optoelectronics and Huacan Optoelectronics, two leading companies in the domestic LED chip field, filed a lawsuit. Sanan Optoelectronics filed two patent infringement lawsuits against Huacan Optoelectronics and its subsidiaries. The lawsuits involved patents "Nitride semiconductor light-emitting device and method for manufacturing the same" and "Semiconductor light-emitting element and semiconductor light-emitting device", which involved the basic technology of LED chip manufacturing. This first patent dispute between major domestic chip manufacturers not only pointed out the importance of patents, but also showed that domestic enterprises' patent awareness and emphasis on innovation are increasing. In November, Silicon Chip Electronics voluntarily withdrew its patent infringement lawsuit with Chipone North. The nearly two-year-long patent case ended with Silicon Chip Electronics' withdrawal, and Chipone North achieved victory in a certain sense. At the same time, Chichuang North also sued another listed company for cloning plagiarism. Chichuang North said that the company always respects the intellectual property rights of its competitors and abides by the principle of fair competition, but will resolutely fight back in the face of attacks without evidence. These patent lawsuits are not only the protection of patents by enterprises, but also an important step for the industry to shift from price competition to technology competition, which will help improve the overall strength of China's LED industry in the long run. The Henan Center of Patent Examination Cooperation of the Patent Office of the State Intellectual Property Office pointed out that at present, the Mini LED technology is in a period of rapid development, but the patent applicants are scattered and have not yet formed a stable pattern. Domestic manufacturers can continue to increase investment in research and development of key technologies such as massive transfer, alignment, and packaging, strengthen patent layout, and use patent cross-licensing and other means to leverage strengths and avoid weaknesses, and better enter the emerging field of Mini LED. At the same time, it is necessary to proactively and appropriately deploy Micro LED technology to avoid missing the more promising market of Micro LED at the end of the Mini LED feast.

Fourth, a number of measures to promote industrial development

The development of an industry is inseparable from the support of policies. In 2020, many policy measures in my country will directly or indirectly promote the development of the LED display application industry.

A series of fiscal and monetary policies of the government in response to the epidemic

In order to minimize the economic impact of the epidemic and ease the pressure on enterprises as much as possible, during the "two sessions" in 2020, the government work report proposed a number of measures, including increasing tax cuts and fee reductions, and reducing the production and operation costs of enterprises. , strengthen financial support for stabilizing enterprises, etc., and use macro policies to help enterprises, especially small, medium and micro enterprises, and individual industrial and commercial households to tide over difficulties.

Among them, the fiscal policy of tax reduction and fee reduction is expected to reduce the new burden of enterprises by more than 2.5 trillion yuan throughout the year. Since the outbreak of the epidemic, calls for tax cuts and fee reductions for companies have become increasingly louder, and various localities have also introduced a number of relief policies based on actual conditions. The shortage of funds for LED display companies has always been a common problem. Among the economic stimulus policies issued by local governments at all levels, there are many projects that directly grant subsidies to enterprises, such as funds for special technology research and development projects. Applying for subsidies can effectively alleviate the financial problems of enterprises. It is understood that in the first quarter of 2020 alone, the amount of subsidies received by Sanan Optoelectronics reached 343 million yuan, of which Sanan Semiconductor Technology received a special subsidy of 200 million yuan. Mulinsen's wholly-owned subsidiaries Harmony Optoelectronics, Huacan Optoelectronics (Zhejiang), Konka Optoelectronics, China Micro Semiconductor and other companies have all received government subsidies of tens of millions of yuan.

In the monetary policy, the policy of deferring the loan repayment of principal and interest for small and medium-sized enterprises will be extended to the end of March 2021. The loans to inclusive small and micro enterprises should be extended as long as possible, and the loans to other difficult enterprises should be extended through negotiation. This is undoubtedly a positive for companies with difficult capital turnover.

new infrastructure

In addition to fiscal and monetary policies, the 2020 State Council Government Work Report also proposes to focus on supporting the "two new and one heavy" construction, that is, to strengthen the construction of new infrastructure, strengthen the construction of new urbanization, and strengthen the construction of major projects such as transportation and water conservancy. Aims to promote consumption to benefit people's livelihood and adjust the structure to increase stamina. Among them, new infrastructure construction represented by 5G, big data centers, artificial intelligence, etc., provides a lot of new opportunities for the future development of LED display companies.

The smart light pole is in the demonstration pilot stage

Terminal display in big data centers has always been the key market for LED displays, and the multi-functional smart pole industry spawned by 5G has brought new markets to smart display terminal LED displays. As an entry point for smart city construction, smart light pole projects have been deployed to a certain extent in many provinces and cities in China. Among them, Shanghai has built 15,000 smart poles since 2018; Shenzhen has built 2,450 smart poles , and strive for 4,500 multi-functional smart poles in 2020; Guangzhou clearly mentioned that 34,000 smart light poles will be built by 2022, and 80,000 by 2025... As an important window for smart light pole display, LED lights The pole screen has huge space for utilization and development.

Strong support for the development of the third-generation semiconductor industry

my country plans to put strong support for the development of the third-generation semiconductor industry into the "14th Five-Year Plan". It is planned to vigorously support the development of third-generation semiconductors in education, scientific research, development, financing, application and other aspects during the period of 2021-2025. industry, in order to achieve industrial independence. The third-generation semiconductor is based on wide-bandgap semiconductor materials such as gallium nitride (GaN) and silicon carbide (SiC). It is the core of new semiconductor lighting, radio frequency microwave devices, and high power density power electronic devices. Lighting, 5G, new energy vehicles, smart grid, rail transit, intelligent manufacturing, radar detection and many other industries.

Although the domestic third-generation semiconductor industry is still in its infancy compared with the United States, Japan, Europe and other places, the favorable policies in the future will undoubtedly lead to a boom in industrial investment, and the development of silicon carbide and gallium nitride raw materials will become the future of the LED display industry. The main driving force of the leap.

Standard system construction

With the popularization of 4K, 8K TV and various types of ultra-high-definition content, the development of ultra-high-definition video industry has accelerated. On May 21, 2020, the Ministry of Industry and Information Technology and the State Administration of Radio and Television initiated the "Guidelines for the Construction of Ultra-HD Video Standard System (2020 Edition)", proposing to initially form an ultra-high-definition video standard system by 2020, and formulate more than 20 urgently needed standards , focusing on the development of key technical standards and test standards such as basic general, content production and broadcasting, terminal presentation, and industry applications. On October 14, at the "5G Audio-Visual Technology and Application Innovation" sub-forum of the 8th China Network Audio-visual Conference, China Ultra HD Video Industry Alliance (CUVA) released the "5G+8K Ultra HD Localization White Paper", which systematically sorted out 5G+ The localization status of the UHD end-to-end industrial chain provides a direction reference for the independent innovation and industrial collaboration of domestic manufacturers in the industrial chain, and provides information assistance for China to complete the localization of the 5G+8K industrial chain as soon as possible.

LED display, especially Mini/Micro LED display, has significant advantages in display effect, response speed, stability and reliability, energy saving and environmental protection, and is an important representative of ultra-high-definition video display. Various standards issued by the government and the industry not only reflect the rapid development of the ultra-high-definition video industry, but also put forward higher requirements for the display carrier of the industry, which in turn forces the development of the Mini/Micro LED industry. The "Guidelines for the Construction of Ultra-HD Video Standard System (2020 Edition)" pointed out that it is expected that by 2022, the overall scale of my country's ultra-high-definition video industry will exceed 4 trillion yuan. In the future, LED displays will be very promising in ultra-high-definition video.

"General Technical Requirements for Asynchronous LED Display Players"

The formulation and release of standards is conducive to further improving the construction of LED display-related standard systems and leading the healthy development of the industry. Up to now, 5 national standards, 8 industry standards, 7 local standards and 2 group standards have been published and implemented in the standards for LED display. In April 2020, the National Flat Panel Display Device Standards Technical Committee organized two national standard seminars in Shenzhen, including "Indoor LED Display Light Comfort Evaluation Requirements". cognition. In May, the group standard "General Technical Requirements for Asynchronous LED Display Players" led by the Standards Committee of the LED Display Application Branch of the China Optics and Optoelectronics Industry Association was publicly reviewed. The standard defines terms, definitions, abbreviations and symbols related to asynchronous LED displays, and puts forward relevant technical requirements, which are representative and authoritative in the industry. In addition, there are 21 groups such as "Outdoor SMD White Light P10 Display Energy Efficiency Limits and Energy Efficiency Grades", "Indoor Small Pitch LED Product Series Spectrum", "General Technical Requirements for Indoor Integrated LED Display Terminals", and "LED Stadium Peripheral Screen". The standard is being formulated, and the industry backbone enterprises such as Leyard, Unilumin, Absen, Alto Electronics, Sansi, and Xida Electronics are all actively participating in the formulation of the group standard.

RCEP & EU-China Agreement

On November 15, 2020, the Regional Comprehensive Economic Partnership (RCEP) was officially signed. This is another important trade agreement signed by China after the WTO. RCEP includes 10 ASEAN countries and China, Japan, South Korea, Australia, and New Zealand, covering a population of 2.2 billion. In 2019, the total GDP accounted for one-third of the world's total, and the trade volume accounted for 27.4% of the world's total trade volume. It is currently the world's largest trade agreement. , is the most important achievement of East Asian economic integration in the past 20 years. On the evening of December 30, the leaders of China and the EU announced the completion of the China-EU investment agreement negotiation as scheduled, ending the seven-year "long run". This "Easter Egg" at the end of 2020 is a big step forward for China-EU relations and is of great significance to both sides.

The formal signing of RCEP and the completion of the China-EU agreement mean the further opening of the Southeast Asian market, the Australian market and the European market. For the LED display application industry, the Southeast Asian market is currently the most stable emerging market in the world. In recent years, the export value of LED display products to Southeast Asia has also gradually increased. With the improvement of the market economy in Southeast Asia and the recovery of the European and Australian economies, mid-to-high-end LED display products will usher in development opportunities.

In addition, a series of favorable measures after the signing of the two major agreements, such as tariff reduction, will help LED display companies optimize product structure and reduce costs, reopen the door for external exchanges, and promote high-quality development of the industry.

Summary: To sum up, in 2020, under the influence of the new crown epidemic, the export of the LED display application industry will be hindered, the competition in the domestic channel market will intensify, the leasing market will shrink seriously, coupled with the increase in raw material prices, capital chain breakage and other factors. Companies were forced to withdraw from the LED display market, and the total output value of the LED display industry declined. However, with the support of government policies and measures, LED display technology has made breakthroughs and developments in packaging, common cathode, small spacing, and new Mini/Micro LED displays. , conference, security and medical and other market segments have achieved different degrees of growth, and the LED display application industry has generally maintained a positive trend and moved forward.

Although the current epidemic has not been completely controlled, and the development trend of the global epidemic in 2021 cannot be determined, but after a whole year of riding the wind and waves, the LED display industry will continue to welcome the development of 2021 with a positive outlook and an attitude of being brave to innovate and not afraid of difficulties!

Subvert the senses, LED display creates an immersive experience

With the increasing pursuit of visual display, the audience is no longer satisfied with just playing the role of spectators in the exhibition, and the emergence of immersive experience just meets people's needs. Over the past few years, an immersive experience craze has been spreading around the world. Recently, according to foreign media reports, the Madison Square Garden Company is investing a lot of money to cooperate with Las Vegas Sands to build an immersive future experience center that combines technology and entertainment: MSG Sphere.

This is the world's largest spherical building composed of LED shells. The building will in the future be the most advanced concert venue in the world: the light-emitting diodes of the building's shell are programmable to display images, including advertisements, on the building's surface. It has countless new technologies, LED full coverage, full immersion experience! Does the world's largest LED shell building set off a huge wave in the unexpanded territory of the display market - the immersive experience hall?

Subvert the senses LED display creates an immersive experience

In addition to the outer shell, this giant LED housing building also has space inside. A giant LED screen will also be installed within the curved walls of the concert hall, allowing for "immersive" performances and augmented reality. Traditional displays often have a "screen" concept. No matter whether the screen is flat, curved, or deformed, the screen always "sees a boundary at a glance" - the function of this boundary will inform the viewer: what you see is only what is on the display screen. The biggest change in the immersive experience is to use technology to remove the boundary of this "screen", allowing the viewer to "fall into the space and world formed by a picture".

To realize this immersive display experience, in addition to the advancement of screen display technology, it also requires the content industry to provide sufficient production, computing and storage capabilities. The large-screen project is enough to drive the development and progress of this industry chain, and it also requires the development and progress of the entire industry chain. In this regard, the LED display industry can fully embrace VR/AR, computer multimedia technology, and at the same time cooperate with the visual content industry to establish a new "display concept highland".

Expand the application market LED display has great potential

Relevant data shows that the number of immersive industry companies exceeded 220 in September 2018, and the immersive industry has become a hot spot for investment and development in the fields of cultural tourism performances, live entertainment, and exhibition pop-ups. In Dianping’s 2017 Consumer Trends Report, searches for “immersive” experiences have grown by as much as 3,800%, and it’s almost impossible for you to find any new type of offline consumer experience to compare with. At present, the three experience types with the highest recognition rate in the Chinese market are immersive live entertainment, immersive new media art exhibitions, and immersive performances. The map composed of the three depicts what the immersive experience represents in the minds of Chinese consumers.

The above three types of experience are undoubtedly closely related to the LED display, and at the same time, the market acuity and technological innovation ability of the screen enterprises are tested. High-quality immersive experience depends on the organic combination of high-quality LED display products and advanced digital technology. combine. With the continuous maturity of technologies such as 5G, artificial intelligence, VR, AR, and blockchain, more and more new technologies will be applied to LED displays, opening a new process of immersive experience, which will further enhance users' experience. Visual experience. However, before that, manufacturers still need to further enhance the matching of LED display and scene at the technical level.

Under the continuous development of LED display technology, its application scenarios are expanding infinitely. In the field of immersive experience display, LED display shows certain feasibility and good application prospects. Moreover, with the future changes in display technology, changing market demands, and accelerating digitalization and intelligentization, the blue ocean of commercial applications of LED displays is also more magnificent. In the future, will LED screen companies develop immersive territory with their excellent products and shine in this brand-new field that few people have set foot on? let us wait and see.

Post time: Feb-28-2022