In 2024, the cost of LED display screens is influenced by screen size, resolution, application environment, technological advancements, market demands, and other hidden factors. These factors span materials, energy consumption, transportation, installation, maintenance, and more, showcasing a multi-layered price differentiation driven by technological innovation.

Table of Contents

ToggleScreen Size and Resolution

Size and resolution have always been the main factors to cost an LED display. For the latter, the great demand for a range of pixel pitches, from P2.5 to P1.5, will be continued in 2024 and somewhat increase in demand as they have been recently very much used by customers in much detail for an image and visual effect. For example, a P2.5 screen, with an area of 10 square meters, costs approximately 80,000 CNY, and a P1.5 screen of similar area can go as high as almost 200,000 CNY. The reason for this drastic difference is that the P1.5 screen has almost three times the pixels in the P2.5 screen; hence, there is going to be a much bigger demand on LED lamps, driver ICs, and core parts.

The screen size is also really important in determining prices. Smaller screens tend to be more expensive per square meter because they require a more complicated production process. For example, a fine-pitch 2-square-meter screen may cost more per square meter than the 10-square-meter large screen because they require more precision in assembly and are more prone to damage during transport. For ultra-large screens, such as those exceeding 500 square meters in stadiums, costs per square meter may decrease by 15%-20% due to modular assembly and optimized logistics.

Screen resolution has a lot of things to do with the application scenario. For advertising screens, they are characterized by lower resolutions like P6-P10, as viewers are usually at a longer distance and need less detail. On the other hand, more resolutions are needed for conference rooms or even control centers; for example, P1.2 or even finer pixel pitches. So far, facts reveal that high-definition screens would account for 40% of the overall LED market in 2024, thus an increase from 12-percentage points from the past year. This is the real consequence of the demand of the growing consumers for finer display effects.

It has implications on supporting equipment. Higher-resolution screens require much stronger video processing capability and stable power systems. A synchronous controller that is 4K compatible has a price range of 50,000 to 80,000 CNY, and it can cost about 200,000 CNY for devices capable of 8K. Aside from hardware, these devices demand higher wiring and debugging service costs, significantly buoying the overall project budgets.

Screen resolution improvement has never been an improvement in linear optimization. An example here would be concerning the P1.2 which has better resolution than P1.5. However, this benefit of visual performance does not justify the increased technical challenge and complexity of production costs. Most users rather pursue cost-effectiveness than the most possible high resolution, especially in commercial and engineering projects.

Application Environment

The application environment determines the material and complexity of the design that will be used in LED screens, which directly influences the cost. There is a great difference in cost structure between indoor and outdoor screens, for outdoors, it needs to be resistant to wind, rain, UV, and other extreme weather conditions. Outdoor screens often use IP65 or higher protection standards, and the cost of waterproof, dustproof, and UV-resistant coatings for outdoor screens is about 25%-30% higher than for indoor screens.

For example, a 50-square-meter LED advertising screen in a city square would cost more than 100,000 CNY just for coating and structural reinforcement, accounting for 15% of the total cost. Besides, outdoor screens require higher brightness to counteract sunlight. An outdoor screen with brightness over 5,000 cd/m² incurs lamp and driver costs about 50% higher than indoor screens, explaining the notable price difference per square meter.

Temperature also has a great effect on the costs of the screens. Screens to be used in high-temperature areas require specific designs to dissipate more heat, while the ones intended for very cold regions must include heating elements. These special designs make production considerably expensive. For example, manufacturers, in some Northern European projects, will have to mount anti-freeze chips and heating modules to make LEDs work at -30°C, which raises the price by 30%-50% per square meter.

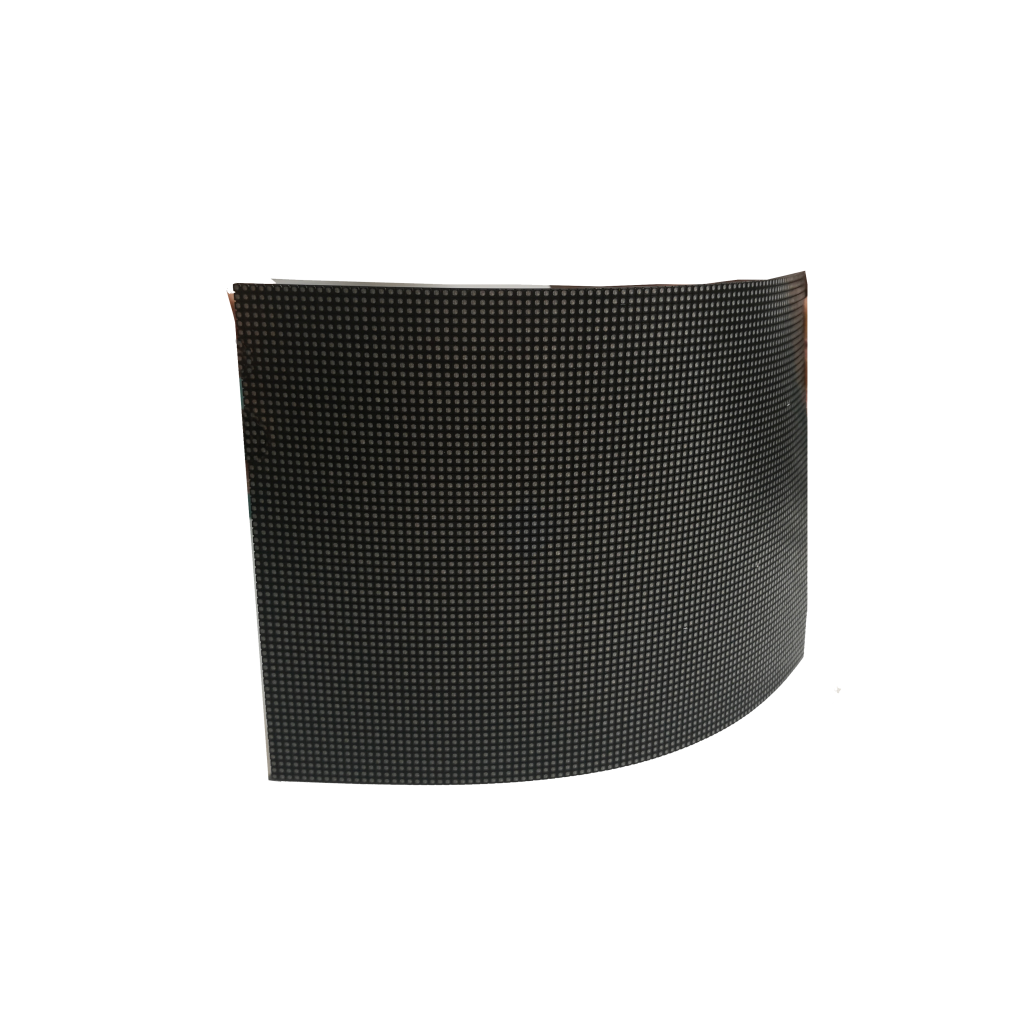

The installation methods are also influenced by the application environment. The curved or irregular screen designs required by many landmark buildings necessitate custom molds and are far more expensive than standard flat screens. Because of the complex craftsmanship and precise assembly techniques, a 20-square-meter curved screen can cost up to twice as much per square meter compared to a regular screen.

In 2024, the demand is increasing very fast for transparent and floor tile screens. A Transparent screen should be above 60% for light transmittance, which balances display quality with natural light. For use in shopping windows, the floor tile screen is designed to bear all the weights, with anti-slip included, and often weighs more than 15,000 CNY per square meter, significantly higher than that of a regular screen.

Technological Advancements

Over the years, advancement in technology has not left behind the ever-changing cost of the LED screen. Micro LED technology is boasting as the “next star” in display fields; however, it will not yet adopt this technology just as the other technologies being available out there. In fact, Micro LED screens charge as high as 500,000 CNY per square meter in 2024, about ten times the cost of conventional SMD screens. This crazy price tag is due to the manufacturing process involved: Micro LED chips are less than 50 micrometers, requiring a precision process of transfer and assembly, and their yield rates are yet to reach the stage of mass production.

On the other hand, Mini LED technology will have matured and established itself in this market at the mid-to-high end levels by 2024. Data shows that prices have fallen from 20,000 CNY per square meter in 2022 to 15,000 CNY in 2024. This accounts for 25% of the reduced prices attributable to improvement in automation and efficiency in chip packaging and, for example, through mixed packaging-like COG and COB, thus producing better performance and less cost overall due to reduced material waste.

Conventional technologies are also constantly optimized. For instance, Chip-On-Board (COB) technology is being used by high-end displays to integrate chips directly onto the circuit board, eliminating traditional bracket packaging. This enhances production efficiency while significantly minimizing the risks of solder failure. According to data, COB screens have a 30% lower failure rate than traditional screens, offering better long-term cost effectiveness even though their initial price is higher.

Advancement of technology also reflects a new upgraded driver system. Whereas single design and installation of driver chips were the norm, integrated driver chips will take more of the limelight starting in 2024. Such chips will incorporate driver, memory, as well as processor functionality, which will result into PCB design simplification. Even if such individual integrated chips come at a very high price, optimized circuitry will, however, reduce by 10%-15% in cost for manufacturing.

Technological advancement, in turn, changes consumer demand. The case in point is interactive LED screens, which recorded rapid growth in the year 2024. This innovative kind of screen integrates touch sensors and sensors for data transmission and allows interaction between two or more users with the utmost application in education and health. They may be more expensive by up to 40% above the price of standard screens, but they cater to many industry needs in terms of multifunctional and innovative designs.

Market Trends

Market dynamics directly affect prices and cost structures of the products. The global LED screen market size is predicted to grow beyond $120 billion in 2024, showing an increase of around 15% for the specific year. Above 70 percent of the shares are controlled by manufacturers in China owing to the efficient production and technological innovations. LED screen exports from China increased by 18% compared to the previous year.

The active market highlights include transparent and flexible screens. Lightweight physical structure and translucent property make the transparent screen a widely used display unit in commercial windows and museum displays. As data shows, the market for transparent screens grew at the rate of 22% in 2024, with prices around 12,000 CNY per square meter, 40%-50% above those for traditional screens. Flexible screens, known for their bendability, are used in stage and creative advertising—they cost nearly 25,000 CNY per square meter, the most expensive segment in the market.

Another trend is growth within the rental markets; during events such as concerts, sporting competitions, and exhibitions, rental LED screens are becoming increasingly popular. By 2024, China’s rental market for LEDs was projected to hit 15 billion CNY with an annual growth rate of 25%. Rental screens typically require quick set-up and modular maintenance, making production and transport costs a little higher than standard ones.

Intensifying competition in the market has also steered price differentiation. Lower-quality mini-manufacturers are often keen to enter the playing field with low-priced products that do not average above the industry standards in both display quality and lifespan. However, utilizing technological innovation and value-added services, high-end brands lure premium customers into the “low-price-for-the-masses, high price-for-customization” trend that is fast emerging in the market.

Regionally, Asia is now the fastest market with countries like India and Southeast Asia recording demand levels that surpassed 20% year-on-year increases, with the growth engines being mainly outdoor advertising and a slew of infrastructure projects. It is this regional growth which will spur further technology improvements and cost reductions in LED screens.

Additional Cost Factors

Hidden costs are an essential factor in the overall costs of LED screens other than material and technology. The most notable example can be the energy consumption. Outdoor LED screens consume an average of 400-600 watts per square meter per hour. A 100-square-meter screen running 12 hours daily may incur annual electricity costs of more than 200,000 CNY, which may be more than its purchase price. Due to this, the manufacturers have focused on low-power technologies. In 2024, energy-efficient driver chips reduced power consumption by about 30%, but those chips cost 20% more and the increased price was passed on to consumers.

Other important factors are transportation and installation costs. Large screens require special packaging and shockproof measures. Transporting a 50-square-meter outdoor screen may cost as much as 30,000 CNY per trip, while international logistics costs even more. Installation is similarly complex: for high-altitude or irregularly shaped screens, equipment and labor account for 40% of total installation costs. In some cities, companies have to pay extra fees to get the installation permit, which indirectly increases the cost.

Long-term use depends on maintenance costs. Although most LED screens can run for 100,000 hours, the service life of core components like LED lamps and driver ICs may be compromised due to external environmental factors. According to statistics, the annual repair rate for LED screens ranges from 5% to 10%. For instance, for a 20-square-meter screen, the cost of lamp replacement can range from 3,000 to 5,000 CNY, while that of the central controller is between 10,000 and 20,000 CNY.

Other cost factors include spare parts and after-sales service. To ensure satisfaction for users, many manufacturers provide 1-3 years of free warranties, and they have to stockpile a large amount of parts, especially fine-pitch LED lamps and driver ICs. The cost of inventory management is usually added to the product price. For small screen projects, after-sales service costs can take up to 8%-10% of all costs.

Environmental regulations are an added layer of cost. With the string of strict laws around the world, LED manufacturers have to manage waste disposal and control carbon emissions during production. In Europe, companies pay extra fees for waste processing, increasing export costs by 5%-8%. Meanwhile, in order to meet environmental requirements, many manufacturers use lead-free soldering and recyclable packaging; this raises costs by about 10% compared to traditional products, while improving market competitiveness.