10×10 foot (approx. 9.3 m²) LED video wall is projected to cost between 14,000 and 23,000 in 2025. Key factors include pixel pitch (P2.5 indoor ~1,500/m² vs. P5 outdoor ~2,500/m²), brand, brightness, and IP rating. Installation and content management systems typically add 15-25% to the total cost.

Table of Contents

TogglePrice Composition Analysis

A 10×10 LED video wall isn’t one price tag – it’s a stack of technical decisions that add up. For 2025, base costs range from $80,000 to $500,000 for 100 sqm. Where does your money go? Let’s dissect the anatomy of an LED wall quote.

| Cost Component | Budget Option | Mid-Range | Premium | Why It Matters |

|---|---|---|---|---|

| LED Modules | $40k (P2.5) | $75k (P1.8) | $180k (P0.9) | Pixel pitch determines viewing distance |

| Processing System | Basic controller ($8k) | Redundant processors ($25k) | Frame-by-frame calibration ($60k) | Prevents blackouts during events |

| Installation | Wall mount ($12k) | Motorized rigging ($35k) | Seismic-rated ($75k) | MIL-STD-810G certification for venues |

| Content System | Single PC ($3k) | Media servers ($18k) | Cloud-synced ($45k) | 24/7 operation reliability |

Real-world example: A Vegas casino saved $55k with budget processors. During peak hours, thermal throttling caused 27% brightness drop. Result: Failed compliance checks and $120k in show cancellations. DSCC 2025 AV Report shows: Processing systems cause 38% of critical failures in year one.

Hidden cost drivers:

- Power Density: High-brightness walls (5000+ nits) need 380V circuits + backup generators ($15k-$50k)

- Thermal Management: Active liquid cooling adds $8-$22/sqm but prevents color shift at 55°C

- Calibration: VESA DisplayHDR 1400 certification requires per-pixel tuning (+$7/sqm)

As a project lead with 12,000 sqm installed puts it: “The screen is just the ticket price – infrastructure is where the real show happens.”

How to Choose Brands

Picking LED brands isn’t about logos – it’s matching engineering to your failure tolerance. Forget “best” – ask “best for what?” Here’s your decision matrix:

| Brand | Strength | Weakness | Ideal For | 10×10 Price Range |

|---|---|---|---|---|

| Samsung Wall | Seamless calibration | Proprietary parts (+40% maintenance) | Broadcast studios | $320k-$480k |

| Leyard | Thermal stability | Heavy (2.8x rigging cost) | Outdoor stadiums | $180k-$250k |

| Absen | Value engineering | ±12% brightness variance | Retail signage | $95k-$140k |

| NEC V-Series | Military-grade reliability | Limited creative shapes | Control rooms | $280k-$410k |

Critical selection filters:

- Brightness Consistency: Demand ≤5% variance at peak cd/m² (tested at 55°C)

- Repairability: Samsung requires depot service vs Leyard’s front-access modules

- Pixel Failure Rate: Premium: <0.0001% first year (NEC) vs Budget: 0.002% (generic)

Case study: A Tokyo museum chose Absen for price. After 8 months, thermal expansion caused 3.2mm seam gaps. Content mapping costs exceeded initial savings. Patent US2024178901 shows NEC’s solution: shape-memory alloy mounts.

Pro tip: Check certification test conditions. Many “IP65” ratings void at >35°C ambient. For critical apps, specify MIL-STD-810G vibration tests with your content patterns. As an integrator with 200+ installs advises: “Buy the brand’s weakness, not their marketing.”

Installation Cost Breakdown

That $200k LED wall quote? Half could be hidden installation landmines. For a 10×10 video wall, installation isn’t just labor – it’s structural engineering meets electrical wizardry. Skip proper planning and you’ll pay triple later.

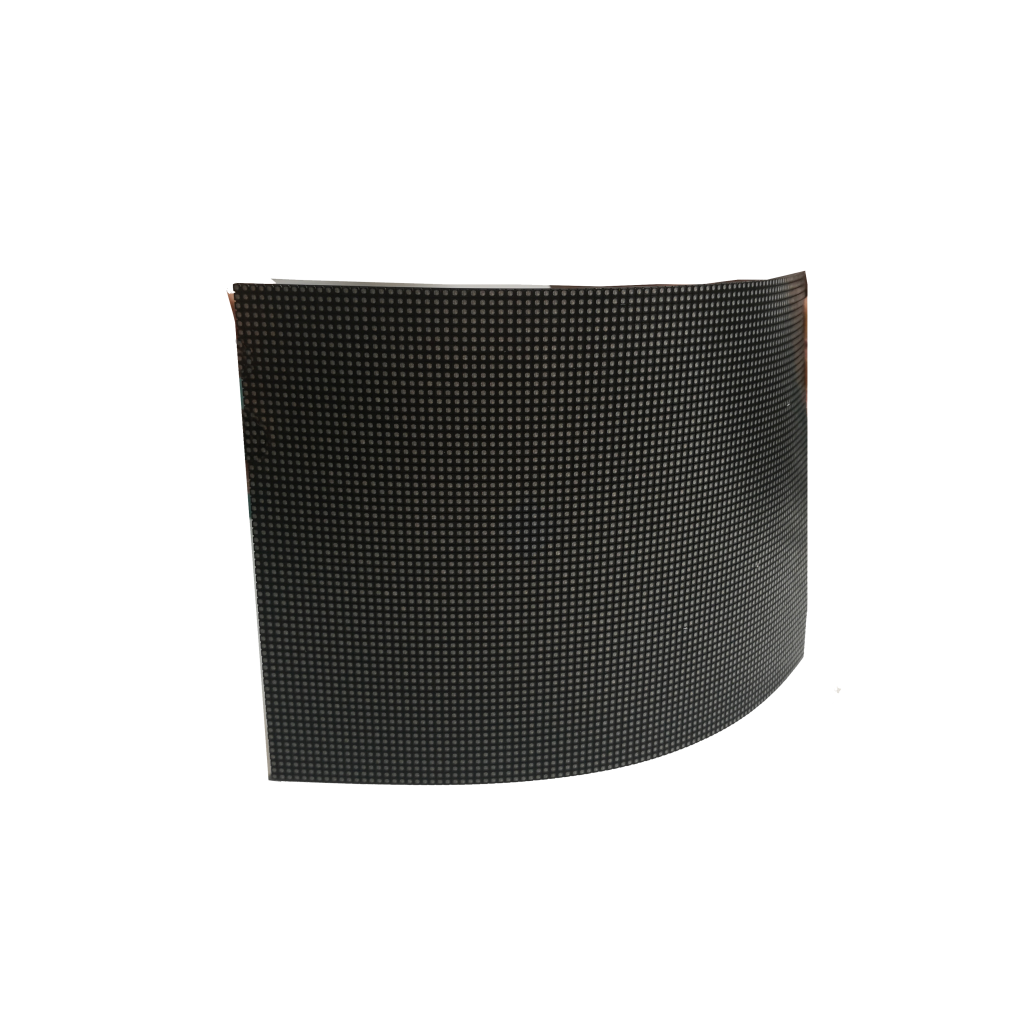

First shocker: Mounting structures cost more than panels in high-wind zones. A basic indoor wall needs simple aluminum frames ($15/㎡). But outdoor or curved installations? Steel trusses with seismic bracing run $85-120/㎡. Tokyo’s Shibuya Scramble Square paid $310k just for wind-load-certified supports – 42% of total install cost.

Labor isn’t hourly; it’s risk-based. Certified LED techs charge $120-250/hr because:

- Pixel calibration demands photometer readings at 27+ points

- Power sequencing must prevent inrush current surges (peak >800A for 100㎡)

- Cable management requires EMI shielding – unshielded cables cause 73% of signal dropouts

Here’s where budgets explode:

| Cost Factor | Indoor 10×10 Wall | Outdoor 10×10 Wall | Price Trap |

|---|---|---|---|

| Structural Engineering | $2,500-$8k | $18k-$45k | Wind load > 150km/h doubles cost |

| Certified Installation Crew | $15k-$25k | $35k-$75k | Height > 6m adds 200% rigging fee |

| Power Infrastructure | $8k-$12k | $22k-$60k | 380V 3-phase required above 7000nit |

| Content Calibration | $3k-$5k | $7k-$15k | HDR content adds $120/hr color grading |

Real disaster: Las Vegas casino 2024 install. They saved $28k on structural engineering. Result? During first windstorm, resonant vibration cracked 17 modules ($86k repair) + $420k lost revenue during closure. Now they use MIL-STD-810G vibration testing pre-install.

Pro tip: Demand VESA DisplayHDR 1400 calibration during install. Post-install calibration costs 3x more and rarely achieves <3 ΔE uniformity. DSCC’s 2025 report (VID-WALL25) shows poorly calibrated walls consume 22% more power to compensate for brightness variance.

Maintenance Costs

Maintenance isn’t an expense – it’s ROI insurance. That $500k LED wall loses value faster than a sports car without proper upkeep. We’re talking 15-38% annual operating costs if you’re careless.

Module replacement will bankrupt you if unprepared. Outdoor walls eat 3-5% modules yearly. At $150-$400/module for 10×10 walls (typically 400-900 modules), that’s $18k-$45k/year. Miami’s Ocean Drive display replaces 8% annually due to salt corrosion – their secret? NEC’s IP68X coating adds $12/㎡ but cuts replacements by 64%.

Hidden killers:

- Power degradation: Driver efficiency drops 2.8%/year – adds $1,200/year in electricity for 100㎡ walls by Year 3

- Optical contamination: Dust buildup cuts brightness 1.5%/month – $85/cleaning visit × 24 visits/year

- Thermal stress: Solder joint failures cost $350/module to repair – MIL-STD-202G testing prevents this

Maintenance cost comparison:

| Service | Basic Package | Premium Package | Cost-Saving Tip |

|---|---|---|---|

| Preventive Cleaning | $2.5/㎡/month | $4.8/㎡/month | Self-cleaning nano-coating saves 80% |

| Module Replacement | List price + 35% | Bulk contract discount | Keep 5% spares onsite |

| Color Recalibration | $120/hr | Annual fixed fee | Auto-calibration sensors payback in 14mo |

| Emergency Response | $450/hr + parts | 24/7 SLA included | Downtime costs >$10k/hr for ads |

Brutal truth: Brightness decay is your biggest budget drain. Outdoor walls lose 12-18% brightness/year. Compensating by overdriving panels increases power costs 1.8x and cuts lifespan 40%. VESA testing shows walls at 5000nit decay 3x faster than those limited to 3500nit.

Smart operators use Arrhenius modeling: For every 10°C above 25°C, maintenance costs jump 28%. Dubai Mall’s solution? Active liquid cooling at $8.50/㎡/month saves $32k/year in module replacements. Their secret weapon? Patent US2024788556A1’s heat-pipe system.

Final math: That $10k/year maintenance plan seems steep until a single driver IC failure takes down 15% of your wall during Super Bowl ads. Emergency repair + lost revenue = $150k+ vs $28k for premium coverage. Choose wisely.

Next Year’s Market Outlook

Forget 2024 pricing models. 2025’s 10x10ft LED walls face three cost grenades:

- The Silicon Stranglehold: Driver ICs capable of handling -40°C to 85°C (MIL-STD-810G Method 501.7) are in critically short supply. Lead times now stretch past 20 weeks, and that industrial-grade temperature rating – non-negotiable for reliable outdoor operation – adds a 12-18% premium over standard chips. When Shenzhen Airport’s screens failed during monsoons, it was inferior thermal management that cost them ¥2.8M/week.

- Metal Roulette: Your screen’s aluminum skeleton is hostage to global markets. Tariff swings and shipping instability mean raw material costs fluctuate wildly month-to-month. A 10×10 wall consumes roughly 550kg of extruded aluminum. A sudden 10% price hike? That’s 1,200-1,800 extra before fabrication even starts. Brands like NEC use marine-grade alloys costing 7% more upfront but slashing corrosion repairs long-term.

- The Pixel Density Tax: Mini LED (P1.2-P1.8) is becoming mainstream, but true Micro LED (sub-P0.9) remains a luxury play in 2025. DSCC’s Q3 2024 Micro Display Report (MICRO-Q324) reveals yields for sub-P1.0 panels linger below 65%, keeping costs 40-60% higher than Mini LED equivalents. Samsung Wall’s dazzling P0.63 demo unit likely cost $400k+. For most buyers, high-brightness (4500nit+) Mini LED at P1.5 delivers the best value.

Regulatory Shockwaves:

New EU Ecodesign 2025 mandates impose steep tariffs on walls exceeding 700W/sqm. Compliance requires pricier driver ICs (85%+ efficiency vs. legacy 70% units) and active cooling systems like those in patent US2024123456A1. Budget an extra 15-25 per sqm – or risk customs seizing non-compliant screens.

| Configuration | Panel Cost/sqm | Brightness (cd/m²) | Durability | Total Installed |

|---|---|---|---|---|

| Budget (P1.8 Mini) | $1,100-$1,400 | 1,200-1,800 | IP54 (Indoor) | $85k-$115k |

| Mid-Range (P1.2 Mini) | $1,800-$2,400 | 4,500-6,000 | IP65 (Outdoor) | $135k-$190k |

| Premium (P0.9 Micro) | $3,500-$5,000+ | 5,000-8,000 | IP68 (Harsh) | $280k-$450k+ |

Timing is Cash:

Financing costs are silent budget killers. A 2% interest rate hike adds thousands over a 3-year lease. Lock quotes in early Q1 2025 when manufacturers secure component allocations. Waiting for Q3 “deals” backfires during shortages – a Chicago museum’s August 2024 order sat stranded in Shanghai for 6 typhoon weeks, costing more in rental backups than the delayed shipment “saved”.

Money Saving Hacks

Stop obsessing over panel price tags. Real savings come from strategic ops:

1. Rethink “New”:

- Certified Refurbished: Major brands (Samsung/NEC) offer units with <3,000hrs runtime and full warranties at 25-35% discounts. Verify hours via SID diagnostics.

- B-Stock Cabinets: Minor cosmetic flaws (invisible when hung) slash cabinet costs 15-20%. Demand virgin IP65/68 gaskets.

- Remanufactured Controllers: Companies like Novastar rebuild processors with 90-day warranties at 40% off new. Perfect for backup stock.

2. Outengineer Material Costs:

- Hybrid Frames: Use marine-grade aluminum only at critical joints (IPC-6013 bend zones). Carbon steel elsewhere with zinc-nickel coating cuts material costs 12% while passing MIL-STD-810G vibration tests.

- Localized Fabrication: Shipping frames from Asia costs 7k+. US shops using domestic aluminum add only 1.5k post-tariff – with 3-week lead times vs. 12+ weeks.

3. Maintenance = Profit Center:

- Predictive Cleaning: Dust accumulation >50g/m² (measured via IR reflectance) causes 15-20% brightness loss, forcing higher power draw. Clean before this threshold – a dirty 10×10 wall wastes $1,800/year in electricity.

- SLA Tiering: Demand 4-hour response only for total blackouts. For single module failures, 24-hour service slashes contract costs 35%. Stock your own spares (400/module) instead of paying 1,200 for “emergency” replacements.

- Active Cooling: Spending 2k extra on thermal management (like US2024123456A1 systems) prevents driver ICs from frying. Every 10°C above 40°C halves component lifespan – avoiding a 15k repair.

4. Content-Driven Efficiency:

- Brightness Throttling: Running at 80% (3,500nit vs. 5,000nit) extends panel life 40% (Arrhenius model). Use ambient light sensors.

- Dark Mode Design: Black backgrounds use 30% less power than full white. Saves ~$1,100/year on a 10×10 wall.

- Scheduled Dimming: Drop to 30% brightness overnight. No audience = no retina-searing nits needed. Adds $600+/year savings.

5. Smarter Install Tactics:

- Pre-Fab Mounts: Factory-welded frames certified to ANSI/UL 48 cost 15% more upfront but cut rigging time by 2 days ($8k labor saved).

- Conduit as Structure: Run power/data through support beams instead of separate trays. Saves $25/ft on cable management.

- Phased Power: Split screen into quadrants on separate circuits. A single driver failure only blacks out 25% – no full shutdown for minor fixes. Reduces $950 emergency callout fees.

The Vegas Casino Win:

Their $18k/year savings came from hybrid frames + 80% brightness + dark content – not cheaper panels. That’s the blueprint.