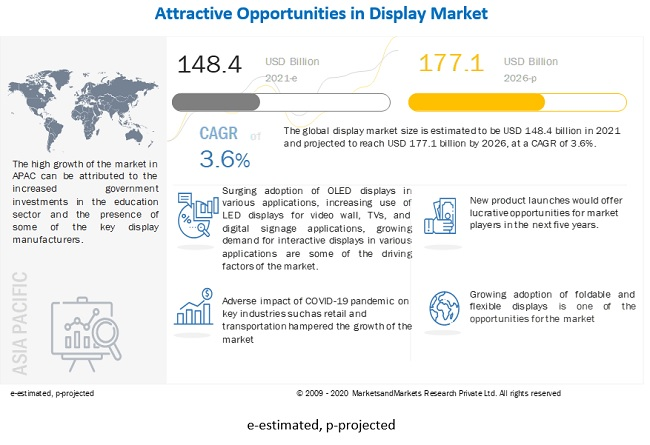

The global display market size was valued at USD 148.4 billion in 2021 and is projected to reach USD 177.1 billion by 2026. It is expected to grow at a CAGR of 3.6% during the forecast period. Surging adoption of OLED displays in various applications, increasing use of LED displays for video wall, TVs, and digital signage applications, growing demand for interactive displays in various applications, and rising demand for display-based medical equipment, including ventilators and respirators, due to COVID-19 pandemic are the key driving factors for the market.

Market Dynamics:

Driver: Increasing use of LED displays for video wall, TVs, and digital signage applications

LED displays are among the most used type of display technology for various applications. It holds a larger size of the market as compared to other technologies. In recent years, the LED display industry has matured, but not in terms of innovation. One of the recent advancements in LED displays is the miniaturization of the parts needed to build an LED screen. Miniaturization has enabled LED screens to become ultra-thin and grow to huge sizes, allowing screens to rest on any surface, inside or outside. Applications of LEDs have multiplied, largely in part due to technological advancements, including enhanced resolution, greater brightness capabilities, product versatility, and the development of hardened surface LEDs and micro LEDs. LED displays are also widely used for digital signage applications, such as for advertising, and digital billboards, which helps brands to stand out from the rest. For instance, in August 2018, Peppermill Casino in Reno, Nevada, mounted a curved LED digital signage video wall from Samsung. Thus, LED displays are widely used to improve customer experience. Some of the leaders in this field are Samsung Electronics (South Korea) and Sony (Japan), followed by LG Corporation (South Korea) and NEC Corporation (Japan).

Restraint: Decline in demand for displays from retail sector due to drastic shift towards online advertisement and shopping

Digital advertising is more sophisticated, personalized, and relevant now. Consumers spend more time online than before, and digital advertising offers an ideal way to reach multi-device, multi-channel consumers. Thus, online advertising has gained popularity in recent years. Moreover, the widespread availability of the internet has spurred tremendous growth in digital advertising. Increased spending on online advertising by various big players, such as Facebook and Google, is also a major factor for the heightened use of online advertising. Programmatic advertising is also gaining momentum. Programmatic advertising refers to the use of automated systems and data to make media buying decisions without human interference. Due to this, the demand for displays, which were earlier used for advertising products and brands in shops and in commercial places, has decreased significantly.

Opportunity: Growing adoption of foldable and flexible displays

Foldable displays have become popular in tablets, smartphones, and notebooks in recent years. Flexible display panels are bendable owing to the flexible substrates used to manufacture them. The flexible substrate can be plastic, metal, or flexible glass; plastic and metal panels are light, thin, and durable and are virtually shatterproof. Foldable phones are based on flexible display technology, which is built around OLED screens. Companies like Samsung and LG are mass-producing flexible OLED display panels for smartphones, television sets, and smartwatches. However, these displays are not exactly flexible from end users’ perspective; manufacturers bend or curve these display panels and use them in end products. Some of the major developers of foldable OLED technologies include Samsung and BOE Technology. In May 2018, BOE demonstrated several new technologies, including a 6.2-inch 1440×3008 foldable (1R) OLED display with a touch layer and a foldable 7.56″ 2048×1535 OLED.

Challenge: Hindrance in supply chain and manufacturing processes due to COVID-19

Many countries had imposed or are continuing to impose lockdowns to contain the spread of COVID-19. This has disrupted the supply chain of various markets, including the display market. Supply chain hindrances are creating challenges for display manufacturers in manufacturing and supplying their products. China is the worst-hit country in terms of display manufacturing due to COVID-19. The manufacturers were allowed only 70% to 75% of capacity utilization compared to the normal rate of 90% to 95%. For instance, Omdia Display, a display manufacturer in China, expects a 40% to 50% drop in its overall display production due to a shortage of labor, shortage of logistics support, and quarantine procedures.

LCD technology to account for a larger share of the display market by 2026

LCD technology has been widely used in display products over the last few decades. Currently, many fields, such as retail, corporate offices, and banks, are using LCD-based products. The LCD segment held the largest market share in 2020 and was a relatively mature segment. However, LED technology is expected to record a prominent growth rate during the forecast period. Advancements in LED technology and its energy-efficient nature is driving the market for this technology. Factors like high competition from newer technologies, disruption in supply-demand ratio, and decline in ASPs of LCD display panels are expected to push the LCD display market toward negative growth during the forecast period. Moreover, Panasonic is planning to cease LCD production by 2021. Key TV manufacturers, such as LG Electronics and Sony, are undergoing massive losses due to the decline in demand for LCD panels.

Smartphones to account for a larger share of the display market by 2026

The market for smartphones is expected to hold a major share of the market. This growth will be propelled mainly by the increasing adoption of OLED and flexible displays by smartphone manufacturers. Shipment of high priced flexible OLED displays are increasing at a rapid rate; this trend is expected to continue during the forecast period. The smart wearables segment has emerged as the new growth avenue for the global market. The demand for these devices is increasing rapidly, and with the high adoption of AR/VR technologies, the demand for smart wearables is expected to increase exponentially during the forecast period.

APAC to witness the highest CAGR in the display market during the forecast period

APAC is expected to witness the highest CAGR during the forecast period. Growing number of display panel manufacturing plants and the speedy adoption of OLED displays are some other factors instrumental in the growth of the market in the region. The cost of labor is low in APAC, which reduces the overall manufacturing costs of display panels. This has attracted various companies to establish their new OLED and LCD panel manufacturing plants in this region. The consumer electronics, retail, BFSI, healthcare, transportation, and sports & entertainment industries are expected to contribute substantially to the growth of the display market in APAC. Additionally, rising adoption of display devices in various industries, especially in countries such as China, India, and South Korea, is a key factor supporting the market growth. Moreover, due to the COVID-19 pandemic, the demand for smartphones and laptops has increased because of work-from-home norms. Also, financial and education institutions are adopting digital teaching methods. These factors are contributing to the increased demand for small- and large-scale displays for commercial and business purposes.

Key Market Players

Samsung Electronics (South Korea), LG Display (South Korea), BOE Technology (China), AU Optronics (Taiwan), and INNOLUX (Taiwan) are among the major players in the display market.

Scope of the Report

|

Report Metric |

Details |

| Market Size Availability for Years | 2017–2026 |

| Base Year | 2020 |

| Forecast Period | 2021–2026 |

| Forecast Units | Value (USD) |

| Segments Covered | By display technology, panel size, product type, vertical, and region |

| Geographies Covered | North America, Europe, APAC, and RoW |

| Companies Covered | Samsung Electronics (South Korea), LG Display (South Korea), Sharp (Foxconn) (Japan), Japan Display (Japan), Innolux (Taiwan), NEC Corporation (Japan), Panasonic Corporation (Japan), Leyard Optoelectronic (Planar) (China), BOE Technology (China), AU Optronics (Taiwan), and Sony (Japan). A total of 20 players are covered. |

This research report categorizes the display market, by display technology, panel size, product type, vertical, and region

Market Based on Display Technology:

- LCD

- OLED

- Micro-LED

- Direct-vew LED

- Other

Market Based on Panel Size:

- Microdisplays

- Small and Medium-sized Panels

- Large Panels

Market Based on Product Type:

- Smartphones

- Television Sets

- PC Monitors & Laptops

- Digital Signage/Large Format Displays

- Automotive Displays

- Tablets

- Smart Wearables

- Smartwatch

- AR HMD

- VR HMD

- Others

Market Based on Vertical:

- Consumer

- Automotive

- Sports & Entertainment

- Transportation

- Retail, Hospitality, and BFSI

- Industrial & Enterprise

- Education

- Healthcare

- Defense & Aerospace

- Others

- Market Based on the Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Rest of Europe

- APACRoW

- China

- Japan

- South Korea

- Taiwan

- Rest of APAC

-

- South America

- Middle East & Africa

Recent Developments

- In April 2020, AU Optronics partnered with PlayNitride Inc., a Micro LED technology provider, to develop high resolution flexible micro LED display technology. AUO and PlayNitride each exerted their expertise in display and LED to jointly develop a leading 9.4-inch high resolution flexible micro LED display with the highest 228 PPI pixel density.

- In February 2020, Samsung unveiled its Onyx screen in Australia at the HOYTS Entertainment Quarter in Moore Park, Sydney, the first in Australia. The new installment features Samsung’s latest 14-meter Onyx Cinema LED screen.

- In January 2020, LG Display unveiled its latest displays and technologies at CES 2020 in Las Vegas from January 7 to 10. The company will introduce a 65-inch Ultra HD (UHD) Bendable OLED display and a 55-inch Full HD (FHD) Transparent OLED display.

- In January 2020, BOE Health Technology and Beijing Emergency Medical Center partnered for the new model of “IoT + pre-hospital care” to apply IoT technology to the process of pre-hospital care and work together to improve the efficiency of pre-hospital care in China.

- In August 2019, LG Display announced the opening of its 8.5th generation (2,200mm x 2,500mm) OLED panel production plant in Guangzhou, China, to produce 10 million large-size OLED panels a year.

Post time: Jun-29-2021